Starting a Point of Sale (POS) business in Nigeria can be a lucrative and profitable venture. With the increasing adoption of cashless transactions in the country, there is a growing demand for POS services, especially in areas where there are limited banking services.

In this article, we will provide a step-by-step guide on how to start a POS business in Nigeria using popular platforms such as Opay, Palmpay, Moniepoint, and Kudi as reference.

Step 1: Conduct Market Research.

Before starting any business, it is essential to conduct market research to determine the viability of the business idea. In the case of a POS business, you need to identify areas with a high demand for POS services, such as market places , motor parks, Junctions, bus stops and densely populated residential areas.

Also, research the competition in the area to understand their pricing, services offered, and customer base. This information will help you to determine your pricing strategy, target customers, and unique selling point.

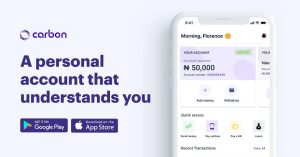

Step 2: Choose a POS Provider .

There are several POS providers in Nigeria, such as Opay, Palmpay, Moniepoint, and Kudi and many others, these platforms offer affordable and reliable POS devices and software that enable you to offer a range of payment options to your customers, such as withdrawals , transfers and payment of utility bills.

Each of these providers has its unique features and pricing plans. Therefore, research and compare their services to determine the most suitable one for your business.

Step 3: Have a Capital Base of at least 100,000 naira.

If you intend profiting from POS Business, then you must have at least a capital of 100,000 naira and above, and that is because you can’t afford to be running to the banks or atm to collect money everytime you run out of cash, you will be losing too much money to transportation and your customers won’t have that confidence they can always find cash with you everytime they are stranded.

For example, you have a cash base of 20,000 naira, and two customers request for a withdrawal of 10k, the whole money is gone, imagine you charge them 200 naira per transaction, if you subtract the commission of the POS provider and you subtract the money for running costs like data and transportation for cash, surely, you will have like 200 naira for profit, so once you go for cash again, your gain reduces to 100 Naira, and you are gradually running out of business.

Step 4: Choose A Good Location

We cannot overemphasize how important location is for a POS business, a bad location can completely ruin your business, POS makes more sales in areas where people need daily cash, places like markets, bustops, junctions have been proven to be good spots for sales.

Another point to consider when looking for a good location is the fact that it should not be close to the bank, or ATM spots because customers will be willing and ready to pay for those locations.

If its close to an ATM spot, they will prefer to queue for cash at the ATM than to pay for charges.

Step 5: Offer Excellent Customer Service To Retain Customers And Attract New Ones

You need to provide excellent customer service. This includes being friendly, helpful, and responsive to customer inquiries and complaints.

Ensure that your POS device is always functional, and transactions are completed promptly. Also, offer value-added services such as airtime recharge, bill payments, and money transfer to attract more customers.

Why People Fail In Pos Business

Poor Account Auditing

One of the most common reasons why POS businesses fail is poor account auditing. As a POS business owner, you must ensure that all transactions are credited to your account by your POS service provider or bank. Failure to audit your account regularly can result in lost revenue, which can have a significant impact on your business’s profitability. To avoid this, it is essential to keep a close eye on your account and ensure that all transactions are being processed correctly.

In addition, it is important to monitor your employees’ activities, especially those who have access to your POS system. Theft by employees can be a major issue in the POS business, and it is your responsibility to ensure that your employees are honest and trustworthy. Conducting regular checks on their accounts and monitoring their activities can help you detect any fraudulent activities early on and take appropriate action.

Lack of Funds

Another reason why most people fail in the POS business is a lack of funds. Running a successful POS business requires a significant amount of capital to cover expenses such as equipment, rent, utilities, and employee salaries. Many entrepreneurs underestimate the amount of capital required to run a POS business and fail to secure adequate funding before starting their venture.

To overcome this challenge, it is essential to have a solid financial plan and secure sufficient funding before launching your business. This can be done by seeking investors or obtaining a loan from a financial institution. It is also important to manage your cash flow effectively to ensure that you have enough funds to cover your expenses and keep your business running smoothly.

Poor Customer Service

Lastly, poor customer service can also contribute to the failure of a POS business. Customers expect fast and efficient service, and if they are not satisfied with the service they receive, they may take their business elsewhere. Poor network stability or slow transaction processing can also lead to frustrated customers and lost revenue.

To improve customer service, it is important to invest in reliable POS equipment and ensure that your network is stable and secure. Additionally, training your employees to provide excellent customer service and ensuring that they have the necessary skills to resolve any issues that may arise can go a long way in improving customer satisfaction.

What To Check Before Paying A Customer

Before paying a customer in POS , there are a few things you should check to ensure that the payment is legitimate and secure:

- Verify the payment amount: Check the payment amount and make sure it matches the amount agreed upon by the customer. For example, if you amount agreed is 2000 naira, check it to confirm its 2000 naira on the receipt and not 20,000 naira.

- Check the card: Make sure the card being used for payment is not expired and has not been reported lost or stolen. Also, verify that the card belongs to the customer and is not a stolen card.

- Check the PIN: If the payment is made by a debit card, ensure that the customer enters the correct PIN.

- Check for fraud: Look for any signs of suspicious behavior, such as the customer attempting to use multiple cards or rushing the transaction.

- Ensure the payment is authorized: Check that the payment is authorized by the issuing bank by waiting for the confirmation message to be displayed on the POS system. If it is a deposit transaction, ensure that the money given to you is counterfeit (fake) and watch out for fake alerts, don’t just look at the transaction successful on the person’s phone, check your POS to confirm the alert.

- Provide a receipt: Once the payment is complete, provide the customer with a receipt that shows the payment amount, date, and transaction ID.

For further inquiry or questions, talk to us the in comment and we will respond swifty.